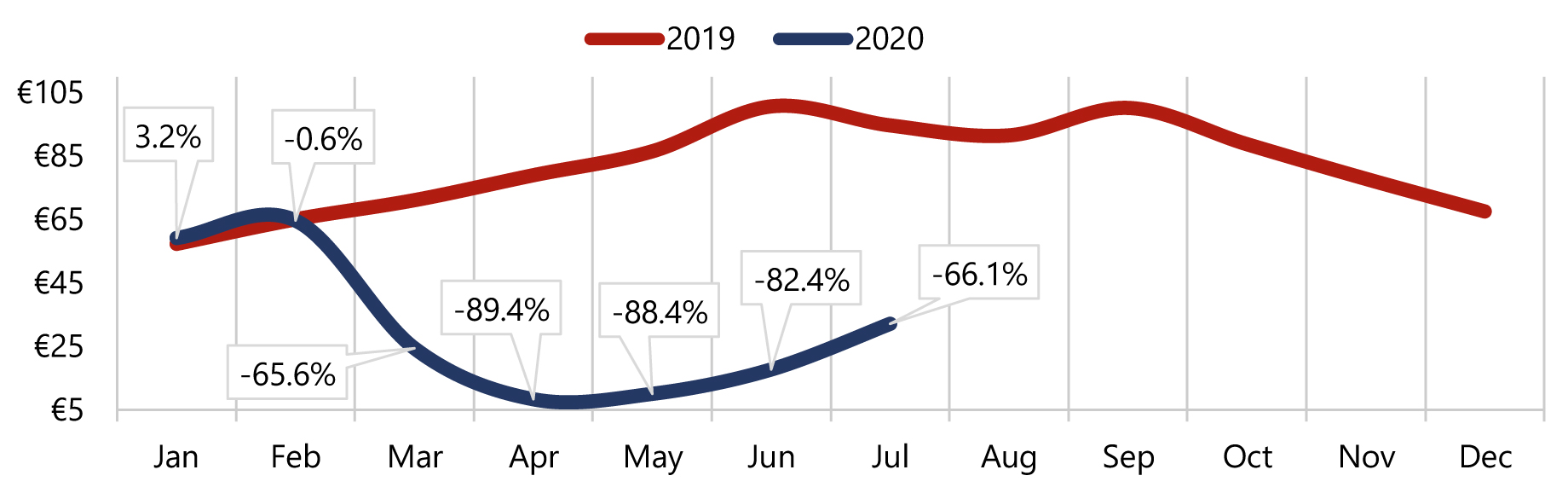

There is no doubt that the COVID-19 pandemic has had a most dramatic effect on the hotel business throughout Europe and words like ‘unprecedented’ and ‘unique’ are used liberally to describe the situation. Performance data from STR for the first half of the year compared with 2019 show how dramatic the effect on the hotel sector has been with RevPAR since March 2020 nose-diving, with many hotels closing their doors. Figure 1 shows the performance of those hotels which remained open during this period. (Adding in those hotels achieving zero RevPAR would make the graph look worse still.)

Figure 1: European Hotels RevPAR (Rooms Revenue per Available Room) 2019-20

Source: STR

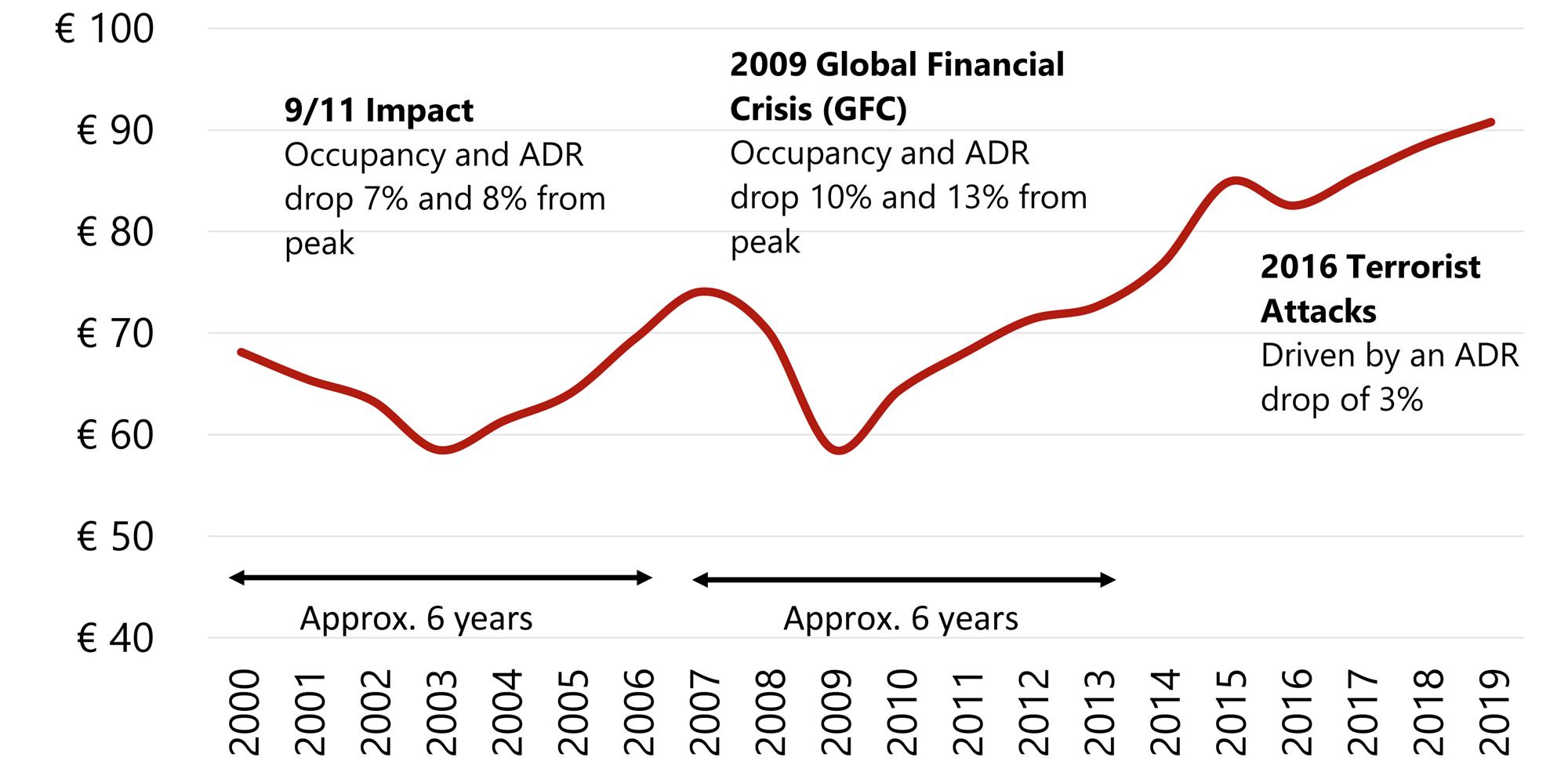

Reflecting back on previous downturns in the last 20 years enables us to recognise that the sharp declines in RevPAR in the period post-9/11 and following the Global Financial Crisis of 2008-09 were followed by a period of recovery, resulting in an overall cycle of some six years in each case. The various terrorist-related atrocities in 2016 in many European cities had a much less devastating impact on hotel performance. See Figure 2.

Figure 2 – RevPAR Recovery Averaged 6 Years post-9/11 and post-GFC

Source: STR

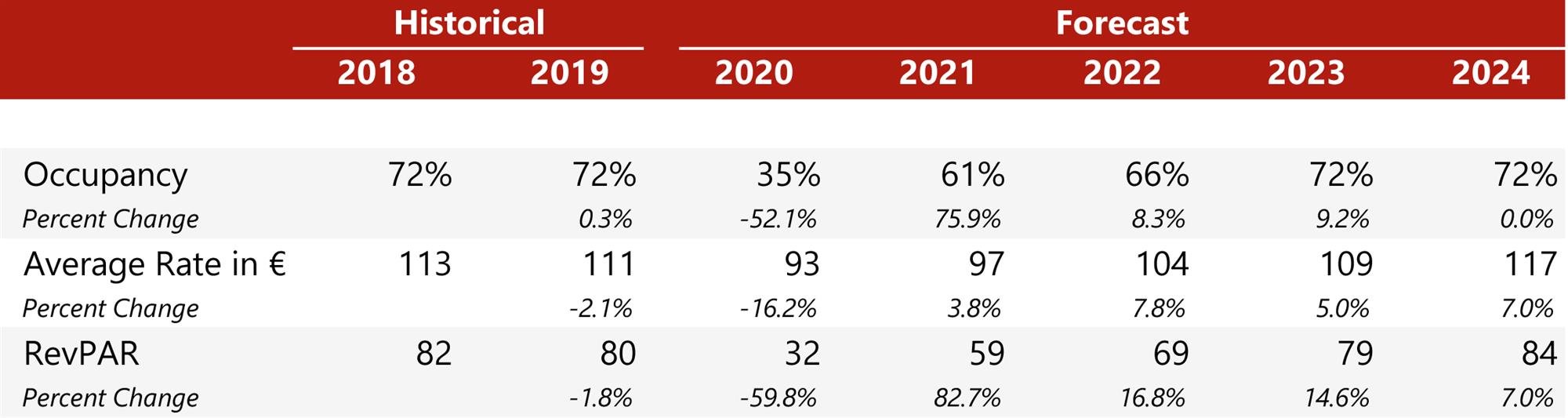

We are therefore encouraged by this resilience and envisage that, notwithstanding the exceptional decline in business during Q2 of 2020, the hotel sector within Europe should have re-established its RevPAR 2019 performance by 2024, as shown in Figure 3.

Figure 3 – Noticeable Recovery Forecast from 2021 – Back to 2019 Levels by 2024

Source: STR (Historics) and HVS (Projections)

These projections are generic and illustrative of how we envisage the European hotel sector recovering from the effects of the pandemic – domestic leisure business leading the way, followed by corporate demand, with international cross-border demand picking up as airlines restart and people feel more comfortable about flying, and MICE business being among the last segments to recover. Clearly, there will be some hotels which will recover faster than the average shown here, but likewise there will be some which will take longer and may never achieve their 2019 performance levels again.

Supply growth has always been a factor in the performance of individual hotels to the extent that new hotels entering a market area can result in a dilution of the available demand. One outcome of the current pandemic is the likelihood that the pipeline of new hotels will come under increasing scrutiny by developers, investors and lenders. Those projects which were well advanced in their construction programme and close to opening will most likely do so, albeit perhaps delayed a little. Those which were at an earlier stage – perhaps not yet fully funded, or where construction was yet to start – will be delayed somewhat further. Some may not go ahead at all if their viability is now questionable, and sourcing bank finance for new development in the next few years will be difficult. On balance, we see the supply of new hotels slowing down considerably until confidence is restored.

Some of the existing supply of hotels will find it hard to reopen – especially if the cost of providing guests with the reassurance they require is considerable. The ‘theatre of cleaning’ is one aspect, maintaining social distancing, providing staff with PPE and appropriate training, limiting ‘touch-points’ between guests and staff, repurposing restaurants, especially buffets, and so forth. Many hotels will come under increasing cash flow pressures as they reopen their facilities with only limited guests in the first instance and a rising cost of operation, depending on how well they manage their staff’s return to work regime post-furlough. It is quite likely that many hoteliers will realise that their staffing complement post-lockdown doesn’t need to look like it was beforehand, which will [or already is?] result in some permanent reductions in staffing levels. Hotel operating companies will also have to look carefully at whether their brand standards can be relaxed to enable each hotel’s profitability to be at an optimal level. There is no doubt that operators are seeking to make some of the recent reductions in operating costs permanent and to benefit from the positive operating leverage which in many instances has seen a 2% change in profitability for every 1% change in revenues.

As hotels reopen and start to build back their businesses – unless they had been able to remain open such as those which were accommodating key workers and so forth – hoteliers will need to focus carefully on ensuring that profitability is maintained and cash flow remains positive. Many will have reached an accommodation with their banks, but this may come under increasing pressure as the moths evolve. At the moment there are no distressed hotels, but plenty of distressed hoteliers, and it is likely that as we move towards the end of 2020, some of these hotels will be offered for sale. The level of pressure from lenders and other parties will indicate the degree to which a sale needs to happen – there seems to be no shortage of potential buyers and a so-called ‘wall of money’ is there to support this [should you mention that the amount of money is higher than ever?]. Bargain hunters are seeking to buy at less than replacement cost and at a significant discount to pre-COVID levels – and any inkling of distress will only serve to encourage such buyers to push prices further downwards.

So, there are some factors worth taking into account by those looking to buy and to sell which have both a downward and upward pressure on prices at which hotels are transacted.

Figure 4 – Factors Influencing Willing Buyers and Willing Sellers

| Downwards Pressure | Upwards Pressure | |||

| ● | Unprecedented revenue and EBITDA decline | ● | Improved business operating model | |

| ● | Economic recession | ● | Return of positive operating leverage | |

| ● | Longer recovery of MICE business | ● | Yield-hungry funds creating competition | |

| ● | Uncertainty regarding normal travel patterns | ● | Low cost of capital likely to continue | |

| ● | Potential for prolonged recovery, re-infection | ● | Some lenders will wait for values to rise before losses are recognised | |

| ● | Cash drain may force owners to sell | |||

| Source: HVS | ||||

As hotel valuers, HVS has continued to carry out hotel valuations during the current pandemic and applied all of the above factors to our thinking in addition to hotel-, market- and location-specific characteristics in each case. In the absence of a wealth of recent comparable transactions, we have also developed a scenario analysis to help illustrate the various conditions a hotel might have experienced. We have then compared this with a ‘base case’, illustrating how the hotel’s performance ought to have evolved in the absence of the COVID pandemic, which is based on a typical European hotel.

Figure 5 – Different Scenarios to Assess EBITDA and Value Ranges

| Baseline | Best Case | Most Likely Case | Worst Case |

| Stable market conditions ignoring the impact of COVID‑19. | Moderate declines in EBITDA. Decline is assumed to diminish over time as the market recovers. | Significant EBITDA impact in the first year. Degree of impact and decline to diminish over time as the market recovers. | Greatest negative EBITDA in the first year, followed by diminishing negative impact as the market recovers. Long recovery period. |

| Source: HVS | |||

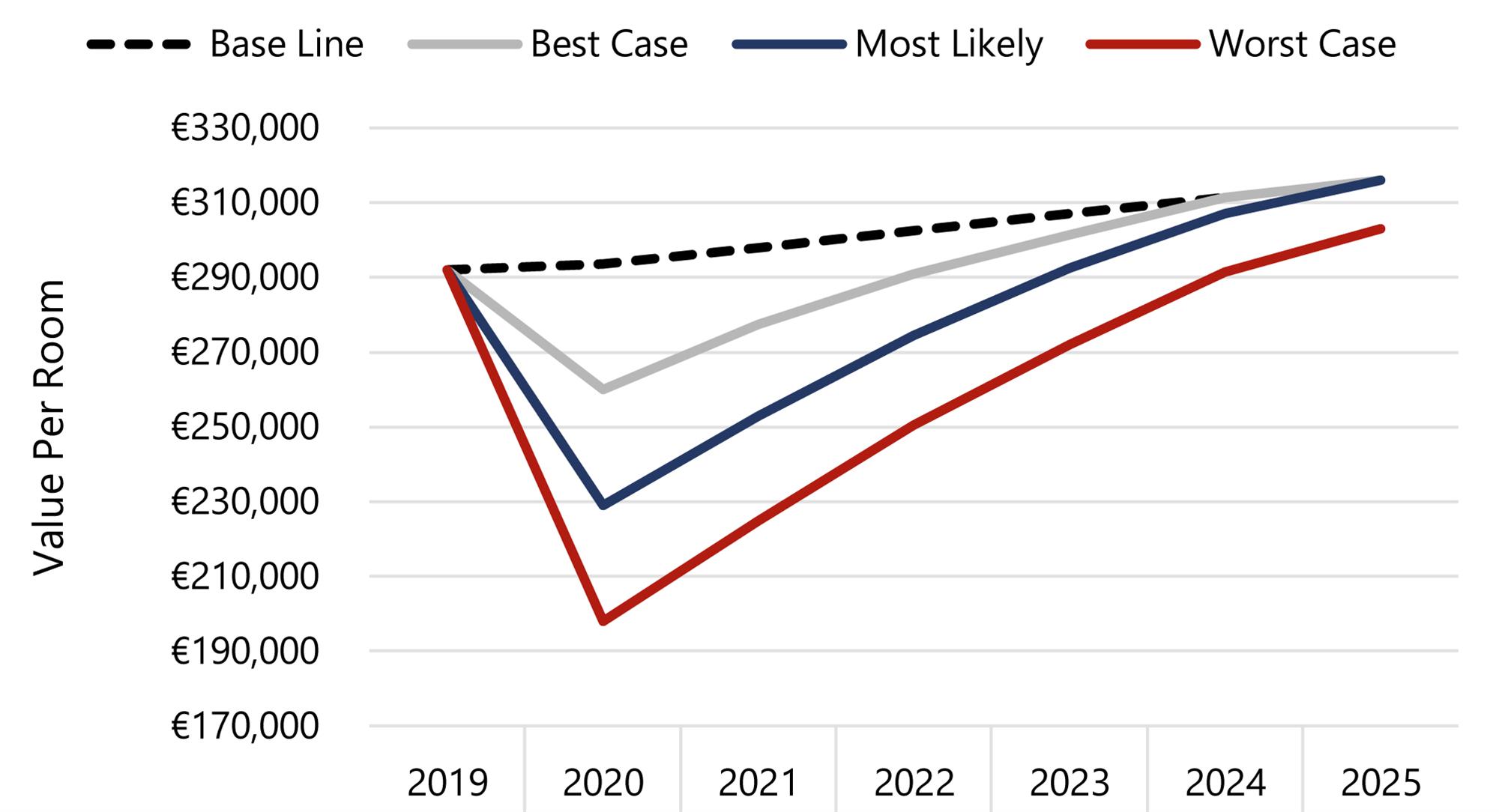

In each scenario, we have applied a higher discount rate in 2020 to reflect the current conditions, which diminishes as the market is expected to recover, albeit at a different pace. Figure 6 illustrates how the value of a typical European hotel could evolve under the three different scenarios plus the base case, the starting point of which is the value of a typical European hotel as at the end of 2019.

Figure 6 – Evolution of Hotel Value Ranges

Source: HVS

Conclusions

As can be seen from Figure 6, the conclusions for each scenario for a typical European hotel are as follows.

- Best Case – the value decline is 5%-10% as of 2020. EBITDA recovers to 2019 levels by 2024;

- Most Likely Case – the value decline is 10%-20% as of 2020. EBITDA recovers to 2019 levels by 2024;

- Worst Case – the value decline is 20%-30% as of 2020. EBITDA recovers to 2019 levels by 2025, although in some cases this could be longer.

For context, our annual Hotel Valuation Index publication showed a 23% decline in value in the downturn which followed the global financial crisis.

The last six months have seen some unprecedented changes in the hotel sector with dramatic declines in RevPAR, the closure of many hotels and the furloughing of many hotel employees. Government support has been evident for both staff and owners in many countries and, as these measures are eased, it is likely to result in a number of permanent job losses throughout the sector. As hotels ramp up their business, those benefiting from drive-to leisure demand are experiencing encouraging levels of performance. Some, especially those relying on international visitors, will take longer to see satisfactory levels of business return, with those reliant on MICE business taking longer still. A vaccine will help to accelerate some of this growth but, in any event, we are positive that the hotel sector will eventually produce strong returns again and remain attractive to investors who recognise their longer-term earnings potential.