Forward Capital seizes a distinctive market opportunity, boasting a robust track record of consistently delivering sound and impactful results within this space

Learn More (PDF)

Terra Nova Fund

Portugal

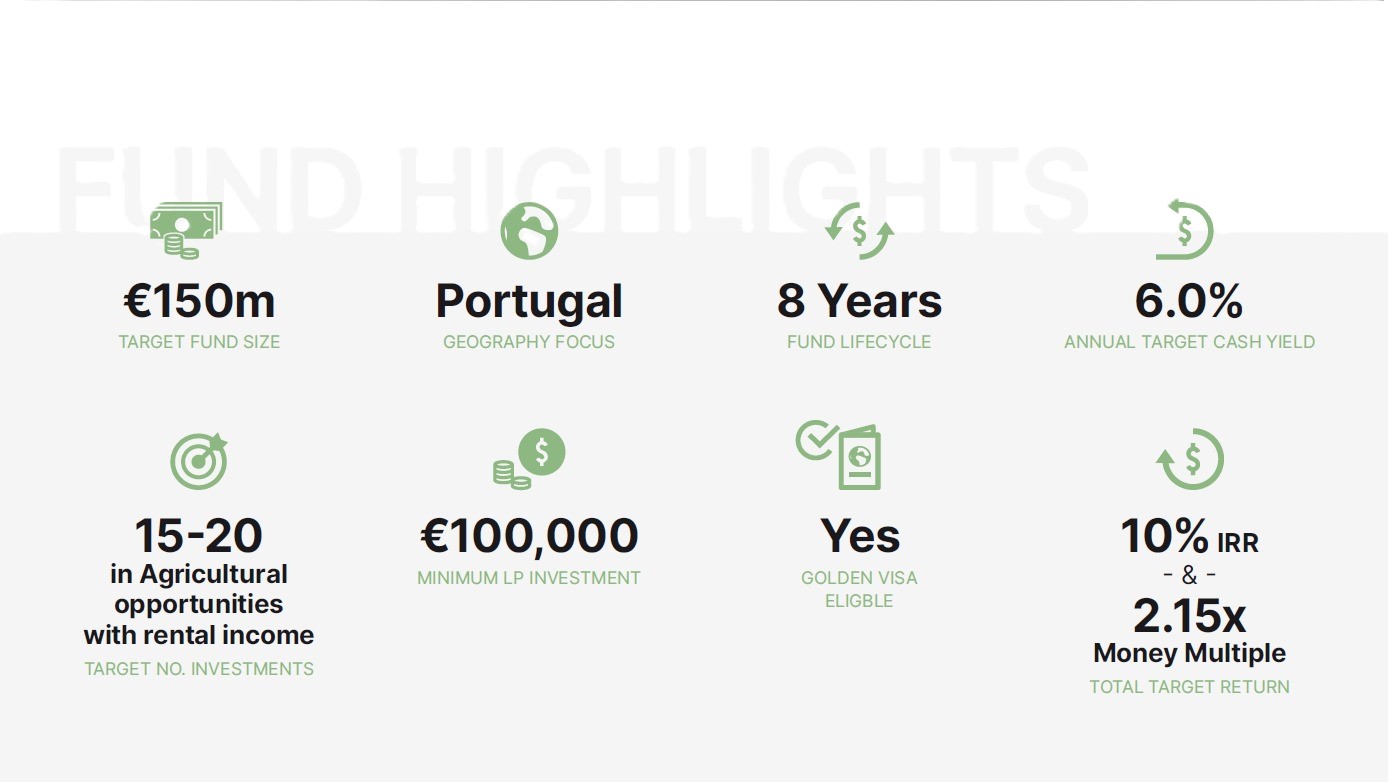

Fund Highlights

The Terra Nova Fund is an investment opportunity that focuses on agricultural land in Portugal. It offers the following benefits and features:

- Expansionary phase of the agriculture sector in Portugal, with strong performance and growth in the Gross Value Added (GVA) of agriculture and exports of agricultural products.

- Unique geographical advantages for agriculture in Portugal, including a mild Mediterranean climate, ample water resources, and good location with excellent road networks.

- Fragmented and unsophisticated agriculture sector in Portugal, presenting opportunities for savvy investors.

- Underpriced land market in Portugal, allowing for favorable entry prices and potential appreciation as the sector modernizes.

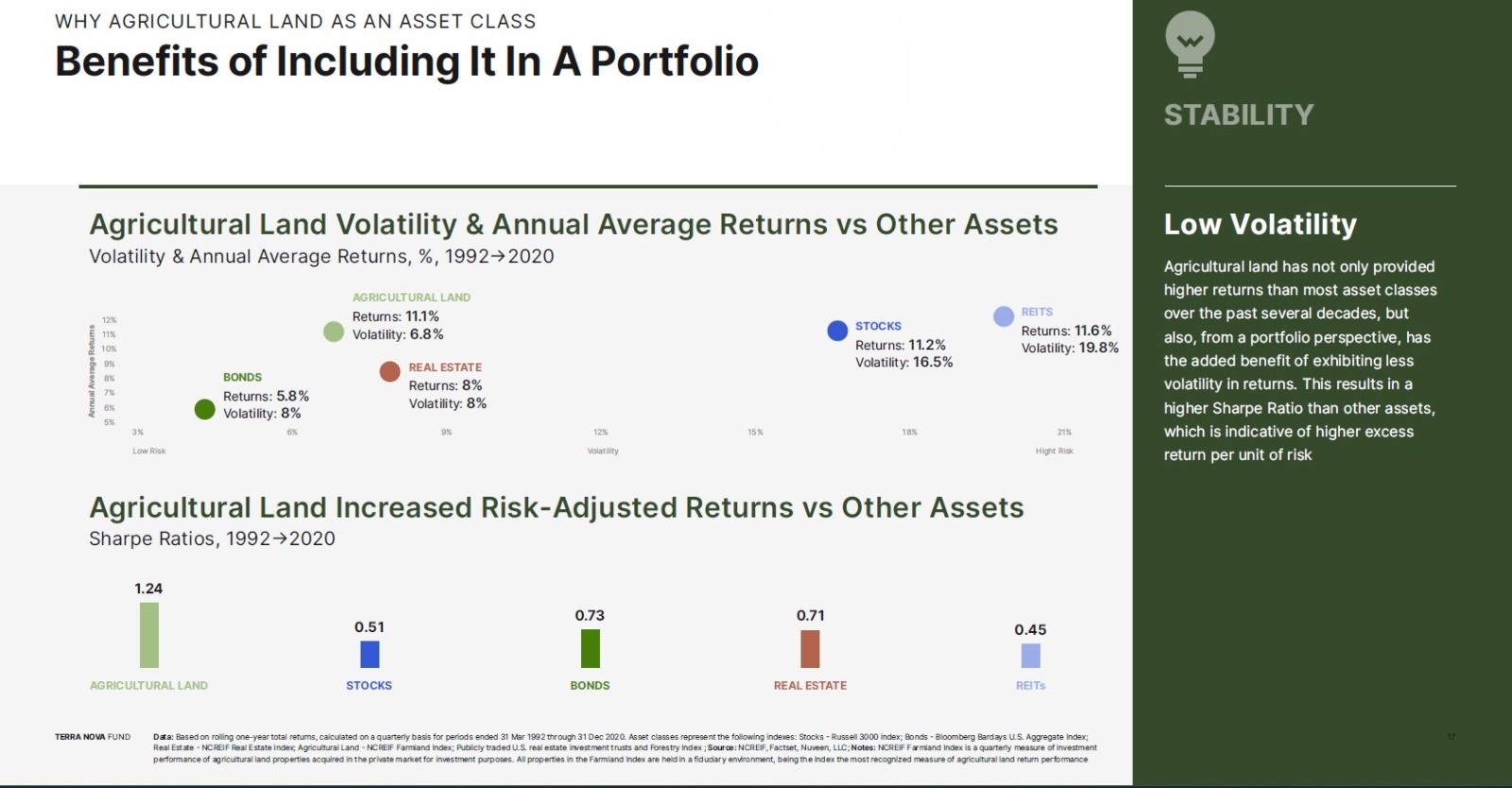

- Historically attractive returns and low volatility of agricultural land as an asset class.

- Exponential valuation during periods of inflation and resilience to economic cycles.

- High correlation of farmland returns with inflation, making it a store of value.

- Diversification benefits and consistent returns of agricultural land in portfolios.

- Long-term growth drivers of agricultural land, such as increasing demand for food and shrinking available land per capita.

- Opportunity to obtain a Golden Visa through investment in the Terra Nova Fund.

- Focus on sustainability and ESG integration in investment process, with due diligence on sustainability and ESG-related risks, selection of sustainable farming practices, and implementation of sustainability KPIs.

- Experienced team and strong pipeline of investment opportunities in agricultural land.

Overall, the Terra Nova Fund offers investors the opportunity to invest in the undervalued and highly desirable agricultural land market in Portugal, with the potential for attractive returns and positive impact.

Mater Hospitality

Portugal

Fund Highlights

The Mater Hospitality Fund is an investment opportunity that focuses on green investment in Portugal with the cooperation of Nativa Capital. It offers the following benefits and features:

- Nativa Capital is a green investment pioneer with over 20 years of track record and managing best practices in the environment.

- Special Fund for Closed Forest Real Estate Investment – First Atlantic Forest Fund (FAFF), which focuses on maritime pine forestry, management of walnut, almond and chestnut orchards, management of grazing contracts, and sale of CO2 emission credits.

- Mater Hospitality Risk Capital Fund, a €140 million initiative aimed at leading hospitality innovation and supporting ventures in the hospitality domain.

- The Mater Hospitality Risk Capital Fund focuses on cutting-edge technology, sustainability, innovation, and talent in the hospitality industry.

- Portugal is an attractive destination for investors due to its economic stability, strategic location, tourism growth, and investments in sustainable energy.

- Nativa Capital has three unique projects: Douro Heritage Resort & Spa in Douro Valley, Convento das Servas Hotel & Spa in Alentejo, and Herdade do Mercador Hotel & Spa in Alqueva.

- The occupancy rates projected over a 7-year period for these projects are 72% for Douro Valley, 62% for Borba, Alentejo, and 0% for Herdade do Mercador, Alqueva.

- The investment terms and conditions include subscription fees, management fees, performance fees, coupon payments, redemption fees, timeline, and PU valuation.

- Nativa Capital is committed to sustainable development and ecological responsibility, and all their projects will obtain LEED certification.

- LEED-certified buildings offer increased demand and resale value, cost efficiency, and market differentiation.

- Nativa Capital’s contact information is provided for further inquiries.